Parental Leave

Avoiding Common Mistakes

This is a guest collaboration series with our friend Stephanie Pow from Crayon - she's building the first home for money and parenthood in New Zealand, helping parents navigate the unique financial puzzles they face so they can be the parents they want to be.

When PaySauce and Crayon started working together, we realised that we had a lot of information and insights to share with New Zealand employers managing parental leave.

We knew that leaders and managers were only dealing with parental leave matters every now and then (unless they work for a large organisation), and we recognised that many were feeling a bit rusty on the details - despite their best intentions to support their employees.

So, we’ve set out to provide a guidebook for employers, with actionable steps to support employees during a joyful but also challenging time in their careers.

Our series covers three core topics:

Common mistakes employers make - and how to avoid them

Employers’ legal requirements when it comes to parental leave

The ways employers can go above and beyond to support employees going on parental leave

Providing a good parental leave experience for your employees is not only a kind thing to do, it makes good business sense. Mistakes made along the way, even when well-meaning, can leave your employees feeling frustrated and under-valued. As an employer, it can not only cause you headaches, but also leave you exposed to legal risk if you aren’t aware of your requirements. With this in mind, we’re kicking off the series by highlighting the common mistakes employers make when handling parental leave and how you can avoid them.

Communication

The mistake: not establishing expectations or methods of communication.

An expectant parent’s last day of work often rushes up before anyone has really had a chance to plan. Sometimes employers don’t even have personal contact details for their employees - only work emails, which of course, the new parent won’t be checking or in some cases even have access to! Another early mistake employers make is asking for information they aren’t entitled to or expecting employees to be available for quick questions after they’ve started their parental leave.

The right way:

Generally accepted wisdom suggests that it is important to ‘regularly’ stay in touch with your employee while they are on parental leave. We would adjust that slightly to say: decide up front, together, how you’ll stay in touch, and how often. You can find a list of suggested questions in Part 3.

It is entirely possible they don’t want weekly or monthly emails checking in while they’re changing nappies and cleaning mashed pumpkin off the floor. It’s possible they might want to stay in touch or come in for a cup of tea in the office every once in a while, but on their terms and schedule.

The mistake: not giving employees the information they need when they’re expecting a baby.

This one is tricky because parental leave is complicated. It can be really hard to stay across the parental leave entitlements, especially for small employers without a dedicated HR person or function. This can leave both the employee and the manager feeling confused.

The right way:

Spend time getting familiar with entitlements and your employment obligations, and seek help if you need it. If you need help with payroll-related entitlements, your payroll provider or accountant can help. If you need help with understanding the employment entitlements, MBIE has good, free resources. If you’re a small business owner without HR or legal advice, a consultant or advisory service can show you the ropes, for a fee.

Once you have it documented, you’ll need to make sure it stays up to date.*

Pay Reviews

The mistake: Leaving expectant or new parents out of remuneration review cycles.

Employers have, on occasion, excluded employees from pay increases in the lead up to the employee going on leave, while they are on leave, or after they’ve returned. To make matters worse, some employers do not communicate with the employee about how their eligibility for increases will be impacted. There’s no question that the parent ends up disadvantaged and disgruntled in these instances.

The right way:

Consider the timing of the pay review cycle(s) and how it might impact your employee, and be prepared to come up with a plan to share with them. Remember that employees aren’t less valuable just because they are taking parental leave and having a baby, and that inflationary and performance based increases are usually still warranted for someone who has worked hard and performed well for you. You don’t want a valued person falling behind their peers in terms of income. Avoiding pay disparity and ensuring fair outcomes is the responsibility of the employer in this case.

Payroll

The mistake: terminating the employee in payroll when they start parental leave and reinstating them as an employee when they get back.

Parental leave still counts as continuous employment, and the employee hasn’t left employment. This mistake could land you in very hot water! If you’ve paid out their leave balance when incorrectly terminating the employee, you’ll have a financial situation to deal with too.

The right way:

Don’t wipe the employee from your books, and especially don’t terminate and pay out leave balances. Keep the employee in your normal systems, including payroll, but record the period of parental leave as your payroll provider instructs. Check in with your payroll support team for guidance if you need it.

The mistake: leaving the employee in the payroll system, but not recording that the employee is on parental leave.

Sometimes the team at PaySauce sees employers record parental leave as unpaid leave every period, or simply skip the employee’s pay so that they aren’t getting paid. Every good payroll system will have a way for employers to record parental leave so that the system knows the employee shouldn’t be paid, but their leave entitlements will still be calculated correctly. Don’t skip or remove the entries that are being created in each pay run by your payroll system.

The right way:

Record their period of parental leave in your payroll system, so that the correct leave entitlements can be calculated while the employee is away. It is really important to do this - parental leave affects the way annual leave is calculated and paid, so your payroll system will need the parental leave information in a specific way to perform the right calculations.

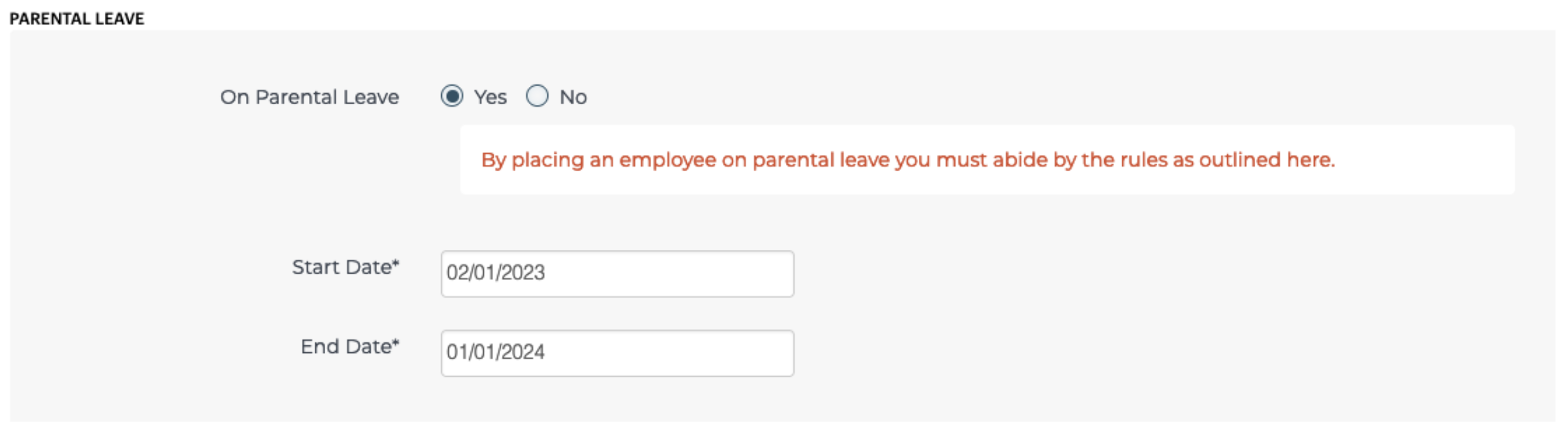

This should be very straightforward. Here’s how it looks to load someone’s parental leave in PaySauce as an example (your system should have similar functionality). You only need to do it once and save it. It also links you to government provided parental leave requirements so you’re always on top of the rules, even when they change.

Annual Leave

The mistake: paying out an employee’s leave balance in full right before they go on parental leave.

This is the correct course of action if the employee actually takes the annual leave before their parental leave starts (and it is often financially beneficial for them to do so), but employers aren’t able to bulk pay out a leave balance when the period of time hasn’t been taken off work - even if the employee requests it.

There are two scenarios where annual leave entitlements can be paid out to someone who hasn’t taken the relevant time away: termination pays (end of employment), and annual leave cash ups. Cash ups can be requested by employees in writing but there are specific rules about cash ups*, and it doesn’t allow for someone’s entire balance to just be emptied out and paid to them. Seek guidance from your friendly payroll provider, accountant, or other trusted source of payroll knowledge.

The right way:

Let your employee know that if they want to use up their annual leave balance right before they start their period of parental leave, then they can. The legislation was changed so that paid parental leave can start immediately after paid leave, even if that’s after the arrival of their child. They simply need to account for taking that time off, away from work. A more flexible option is slowly using it up for days or half days as needed over a period of time before they start their parental leave. It's really good to raise the annual leave topic nice and early so that you and the employee can be on the same page and have plenty of time to plan and handover.

Employees usually aren’t aware that the payment rate for their annual leave will be impacted when they return to work too, so it's nice to give them a heads up about that (it’s one of the curveballs in Crayon’s article What You Don’t Expect When You’re Expecting).

The mistake: removing or adjusting an employee’s leave balance when they return to work after parental leave.

Some employers think or feel that an employee isn’t entitled to earn annual leave while they’re away looking after their child. By law, all employees are entitled to receive four weeks of annual leave for every 12 months of full-time employment, and parental leave counts as employment. Employees also continue to earn sick leave, so this shouldn’t be removed either. Employers who adjust or remove the leave balance expose themselves to unnecessary legal risk.

The right way:

Enter the parental leave information in the right place, and let your payroll system make the calculations for you with regard to what the employee is entitled to. At PaySauce, we encourage employers to call our support team when someone is returning from parental leave just for peace of mind so we can go through the calculations with you and answer any questions.

Last but not least...

We often find that smaller organisations don’t have a parental leave policy. You may have had very few employees take parental leave, or you offer the government standard, and therefore deem that a policy is unnecessary.

In reality, a parental leave policy is good practice for every organisation, regardless of your size or offering. It makes the expectations clear for employees and their managers. Make sure this policy is given to employees on hiring and can always be found by every employee, not buried in the depths of an intranet or an unused handbook.

Employees are increasingly factoring their finances into their decision to start or grow their family. The better they can plan ahead, the better chance of a successful return to work.

Stephanie Pow

Founder & CEO - Crayon

Stephanie Pow

Founder & CEO - Crayon

Jessica McLean

CPO - PaySauce

Jessica McLean

CPO - PaySauce